Inflation is the act of raising the money supply, which in turn raises the prices of goods and services because the more money a government prints the less that money is worth, so the less it will buy you.

So it really refers to two related actions:

“As the money supply increases the currency loses it’s purchasing power and the price of goods and services increases”. Webster’s New Universal Unabridged Dictionary published in 1983 (R1)

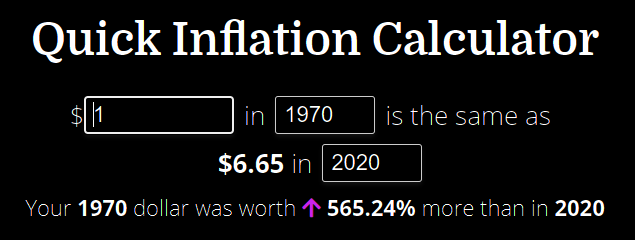

(R2)

(R2)

An increase in the amount of currency in circulation, results in a fall in its value and thus rising prices. This may be caused by an increase in the volume of fiat money issued or a relative increase in expenditures as when the supply of goods fails to meet the demand. The net result is that fiat currency inflation is a “hidden tax” on consumers and is the primary cause of price inflation.

INFLATION EXAMPLE:

To fund World War I, Germany decided to come off the gold standard and fund the war by borrowing the money. They planned to saddle that debt on the UK and France once they won – this is what Germany did to France after the Franco-Prussian War (1870-71). However, Germany lost the war and was forced to pay war reparations. They did this by the mass printing of Marks to buy foreign currency, which was then used to pay reparations, but this strategy backfired into hyperinflation. Within a year, the German Mark was practically worthless – a loaf of bread cost about 160 Marks at the end of 1922 cost 200,000,000,000 Marks by 1923. (R3)

REFERENCES:

R1: https://inflationdata.com/articles/2010/07/21/real-definition-inflation/

R2: https://quickinflationcalculator.com/index.php

R3: https://en.wikipedia.org/wiki/Hyperinflation_in_the_Weimar_Republic

R4: https://www.youtube.com/user/crashcourse/videos